Obtaining a mortgage as a self-employed individual presents unique challenges, primarily navigating the complexities of Fannie Mae's cash flow analysis. This comprehensive guide provides a step-by-step approach, empowering both lenders and self-employed borrowers to confidently meet Fannie Mae's requirements. We'll demystify the process, highlighting key guidelines and common pitfalls to ensure a smooth and successful mortgage application.

Understanding Fannie Mae's Guidelines: A Foundation for Success

Fannie Mae's guidelines for self-employed borrowers are designed to assess income stability and the long-term viability of your business. They require a detailed and accurate picture of your financial health. Don't think of this as an obstacle; consider it a chance to showcase your financial responsibility and your business’s success. The process involves meticulous documentation, ensuring transparency and consistency in your financial reporting.

Fannie Mae primarily focuses on two key aspects: consistent income and business stability. To evaluate these, they'll thoroughly review your financial records, including:

- Tax Returns (Forms 1040, Schedules C and SE): Two years' worth of both personal and business tax returns are typically required. These provide a detailed history of your income and expenses. Are you wondering if there are exceptions? Yes, but they require specific circumstances and documentation.

- Business Financial Statements: These include profit and loss statements and balance sheets, offering a comprehensive overview of your business's financial performance. Consistent reporting from year to year is critical to demonstrating income stability.

- Bank Statements: These provide supporting evidence for the financial information presented in your tax returns and financial statements. Be prepared to provide them if requested.

Incomplete or inaccurate information can significantly delay the process or even lead to rejection. Accuracy and thoroughness are paramount. Think of your preparation as building a solid, transparent case for your financial health.

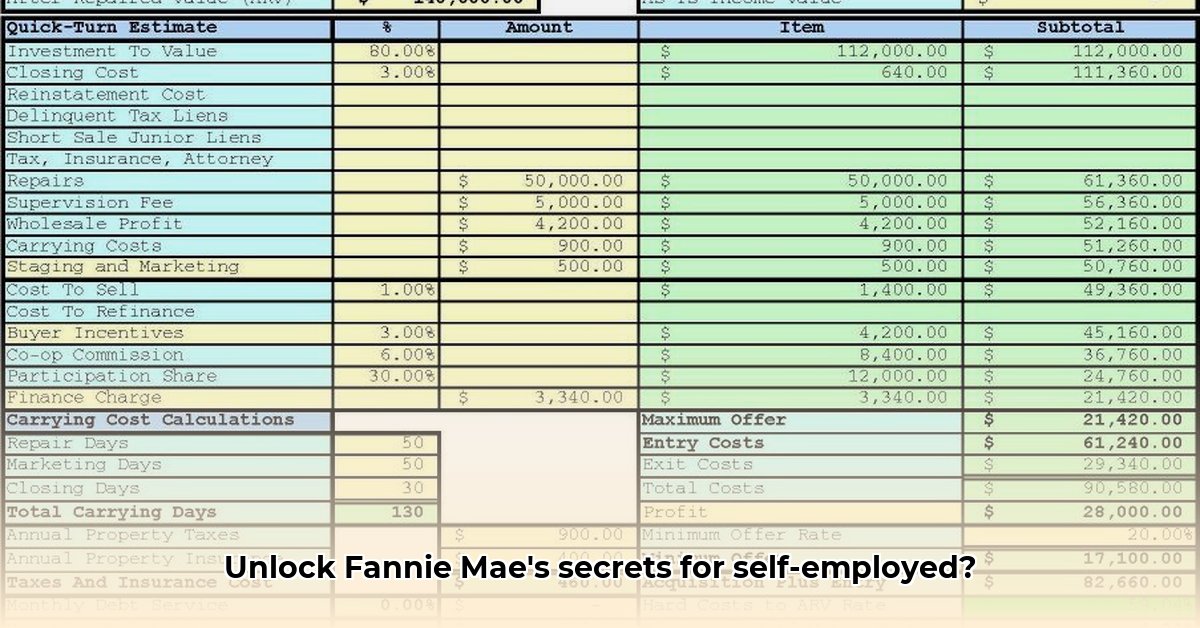

Step-by-Step Cash Flow Analysis: A Practical Approach

This section details the cash flow analysis process, crucial for demonstrating your ability to repay a mortgage. Accuracy is paramount; even small errors can have significant consequences. Consider seeking professional help if your financial situation is complex.

Step 1: Gather Your Documents. Compile two years of tax returns (Forms 1040, Schedules C and SE), business financial statements (profit and loss statements and balance sheets), and bank statements. Having these organized will significantly streamline the process.

Step 2: Prepare Your Business Financial Statements. Ensure your business financial statements are accurate, up-to-date, and reflect your business's financial health. Consistent reporting year-over-year demonstrates stability. Seek professional help if necessary.

Step 3: Complete the Fannie Mae Forms (or Equivalent). Fannie Mae offers specific forms; alternatively, create a comprehensive financial statement providing the same information. Clarity and completeness are vital.

Step 4: Calculate Net Income. Calculate your net income by subtracting business expenses from gross income. Fannie Mae scrutinizes expense deductions, so ensure legitimacy and proper documentation.

Step 5: Analyze Income Trends. Evaluate income trends over two years. Explain any significant fluctuations, highlighting consistency where possible.

Step 6: Document Exceptions. If exceptions exist (e.g., new business, income fluctuations), provide additional documentation (business plans, projections, client letters). Transparency is crucial.

Step 7: Review and Verify. Meticulously review all documents for accuracy and completeness. A second review is highly recommended.

Handling Exceptions and Special Circumstances: Navigating the Nuances

Several situations warrant special consideration:

- New Businesses: For businesses less than two years old, provide a detailed business plan, projections, or other evidence demonstrating stability.

- Using Business Assets for Down Payment: Clearly demonstrate how using business assets for the down payment won’t jeopardize your business's financial health. Provide supporting documentation.

- Income Fluctuations: Thoroughly explain any significant income variations, providing supporting documentation for any unusual circumstances.

Remember, transparency and thorough documentation are key to addressing these exceptions successfully.

Common Pitfalls and Mistakes: Avoiding Costly Errors

Several common mistakes can derail your application. Understanding these pitfalls will help ensure a smooth process. A single error can have significant consequences.

- Inaccurate Financial Statements: Double-check all figures. Professional help can bolster accuracy.

- Incomplete Documentation: Gather all necessary documents well in advance. Last-minute rushes increase error rates.

- Inconsistent Income Reporting: Maintain detailed and consistent business records throughout the year.

- Failure to Address Exceptions: Clearly explain unusual circumstances or income fluctuations.

Useful Tools and Resources: Leveraging Available Support

Several tools can streamline the cash flow analysis:

- Fannie Mae Selling Guide: https://selling-guide.fanniemae.com/ This comprehensive guide offers detailed instructions and requirements.

- Accounting Software: Software can help maintain accurate, consistent financial records.

- Financial Advisors: Professional advice can be invaluable, particularly for complex financial situations.

Conclusion: Presenting a Compelling Financial Narrative

Successfully navigating Fannie Mae's cash flow analysis involves more than just numbers; it's about presenting a compelling narrative of financial responsibility and stability. By meticulously following this guide, addressing any exceptions transparently, and presenting a clear picture of your financial health, you significantly increase your chances of mortgage approval. Thorough preparation is the key to success.